Babylon's Solution to Long-Range Attacks

By far, the only BTC staking protocol that makes sense.

We’ve seen countless BTC staking protocols pop up in the past year, all aiming to tap into the US$1.2 trillion worth of idle, “hard” BTC. Hopping on the orange train, most of them involve bridging BTC over to EVM-compatible chains (often their self-created ones) and employing delta-neutral or LP strategies on a “wrapped” version of BTC.

Sure, it does put those idle assets to work, but it's often hyped up as more revolutionary than it actually is.

The fundamental problem is this: Bitcoin doesn’t fully rely on economic security

Relying on PoW means there's no way for non-miners to earn tangible yield by contributing to the network. Miners are rewarded for their “work” - aka computational power used to validate transactions and secure the chain, which can be considered a form of ‘real’ yield alloted based on a quantifiable metric.

PoS chains are different - where staking exists as a core function for validators to secure the network by providing capital.

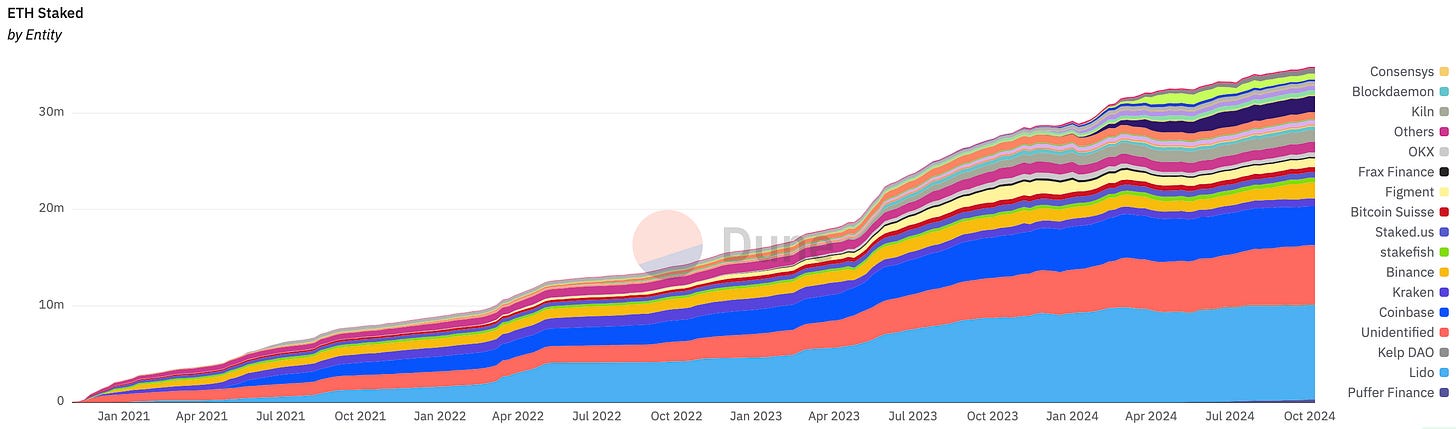

Take ETH for example:

As of writing, there’s approximately 34.5 million ETH staked (28.4% of its total supply). This is equivalent to US$85 billion - a massive pool of economic security.

Staking, by itself, created a US$65.3 billion sector comprising LSTs, restaking, and LRTs - all effectively putting a user’s assets to work.

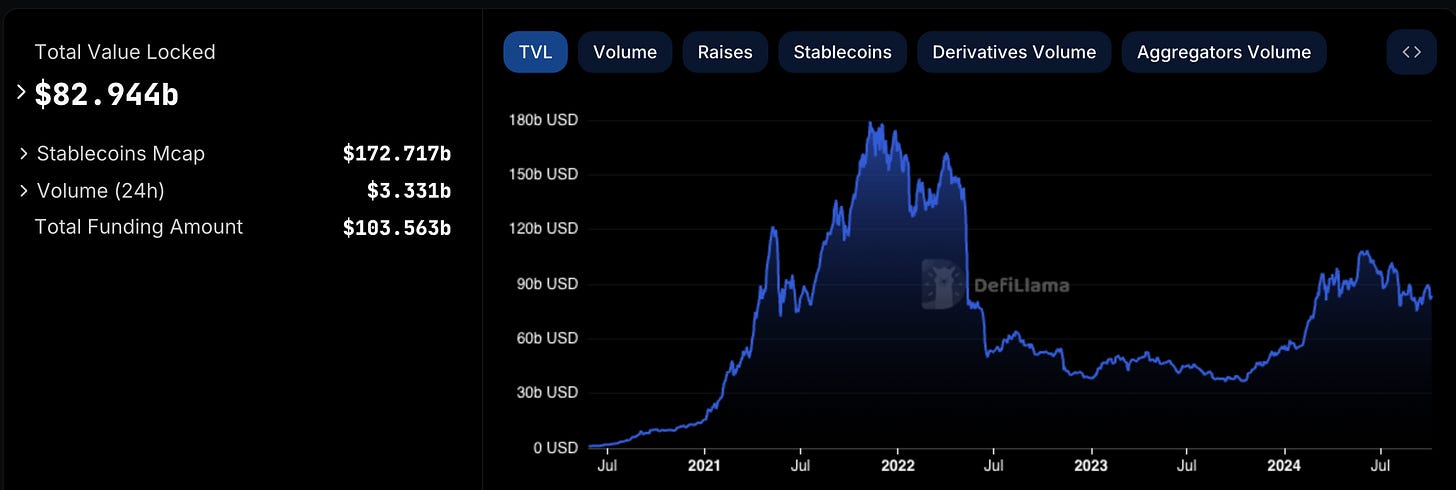

Outside of this massive sector, BTC primarily exists as a store of value. The trillion-dollar asset is left idle in wallets held by users, institutions, and ETF issuers — with no direct way to generate yield on them.

This is a result of Bitcoin’s limited expressiveness in programmability, missing out on the US$82 billion sector of DeFi built on smart contracts. Let’s face it, the only actionable thing you could do with BTC (on chain) is to make a transfer, else you leave them lying in your wallet.

But over time, tons of programmers have began their attempts to give life to the mother chain - creating Ordinals, BRC20, Runes, and other indirect avenues to earn yield on BTC.

The problem with these BTC staking projects is that they aren’t proposing a valid solution, but rather taking an easy way out.

As smart contracts don’t exist on Bitcoin (which relies on scripts), numerous EVM-compatible “BTC L2s” emerged - conveniently pulling native BTC away from the original chain to execute yield strategies on their programmable chain.

This usually involves bridging, wrapping, and other inorganic ways of utilizing native BTC, exposing assets to a wide amount of risk associated with custody, interoperability and code vulnerability.

Enter Babylon

Babylon enables native BTC staking on the Bitcoin network, securing PoS chains while generating yield.

Co-founders:

David Tse is a Stanford professor and expert in wireless communications and information theory.

Mingchao (Fisher) Yu is a seasoned engineer with a background in telecommunications and patented algorithm development.

Funding

Total raised: US$96 million

Backed by: Paradigm, Polychain Capital, Hashkey Capital, Binance Labs, OKX Ventures etc.

This solves two problems at once:

1) native BTC cannot generate yield without leaving the chain

2) PoS chains, especially those in their early stages, lack security measures with low economic security

By providing a comprehensive solution to security weaknesses in PoS chains, Babylon enables tangible yield to be earned on BTC.

The Challenge: Long-range Attacks

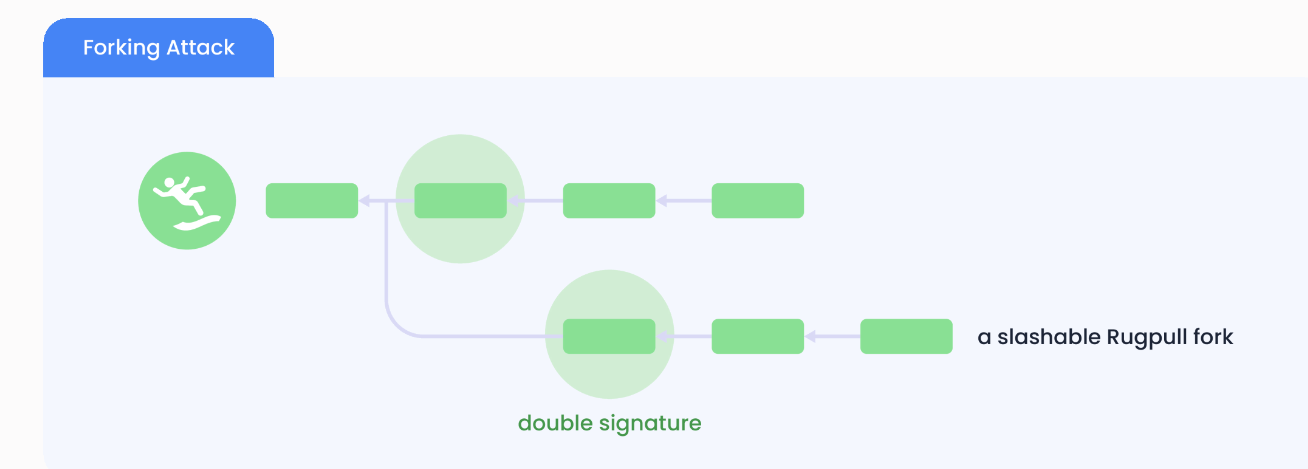

PoS chains are vulnerable to long-range attacks (especially ones with lower TVL), where a malicious actor builds a fork from a historical block to the current height, trying to overtake the real chain by gaining majority validator support.

New nodes or nodes that have been offline for a while may synchronize with the attacker's chain, believing it to be the real one due to its length or accumulated stake.

Implications of Long-Range Attacks

Double-Spending: The attacker can reverse transactions, spending the same tokens multiple times.

Network Disruption: Trust in the network's integrity diminishes, potentially leading to significant economic losses.

Security Erosion: The attack exploits the low cost of chain extension in PoS systems, undermining their security model.

Social Consensus: A Weak Solution?

To counter long-range attacks, many PoS networks rely on social consensus:

which involves stakeholders periodically making off-chain decisions about the correct state of the chain.

By agreeing on specific checkpoints or finalized blocks, the community collectively rejects conflicting chains that might emerge.

However, this introduces subjectivity - as the acceptance of the valid chain depends on the stakeholders' collective agreement, which may not always be unanimous or timely. Social consensus processes are also slow, delaying responses to attacks and potentially allowing malicious forks to gain traction.

Mitigations

To defend against long-range attacks, PoS networks often implement long unbonding periods (sometimes lasting several weeks), which can negatively impact liquidity and UX for validators and delegators.

Furthermore, chains (especially those in their early bootstrapping phases) often depend on token incentives to attract new validators to contribute to the economic stake, which typically results in high inflation rates.

How BTC Comes into Play (and why BTC)

Babylon leverages the security and immutability of Bitcoin to secure PoS chains. By using native BTC for timestamping, PoS chains can anchor their block data to an objective, tamper-proof ledger.

Timestamping involves embedding PoS chain block hashes in Bitcoin transactions, providing an immutable reference that PoS nodes can use to validate their chain.

This effectively neutralizes long-range attacks as validators would be able to recognise a malicious fork with later timestamps. Since altering Bitcoin's blockchain is practically impossible, this method provides a swift and objective solution, eliminating the need for social consensus and long unbonding periods.

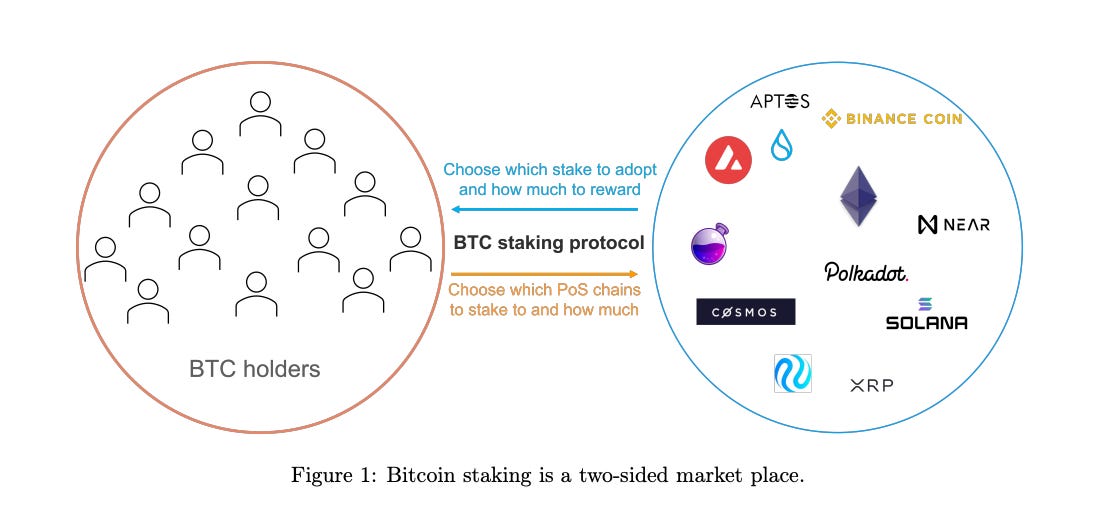

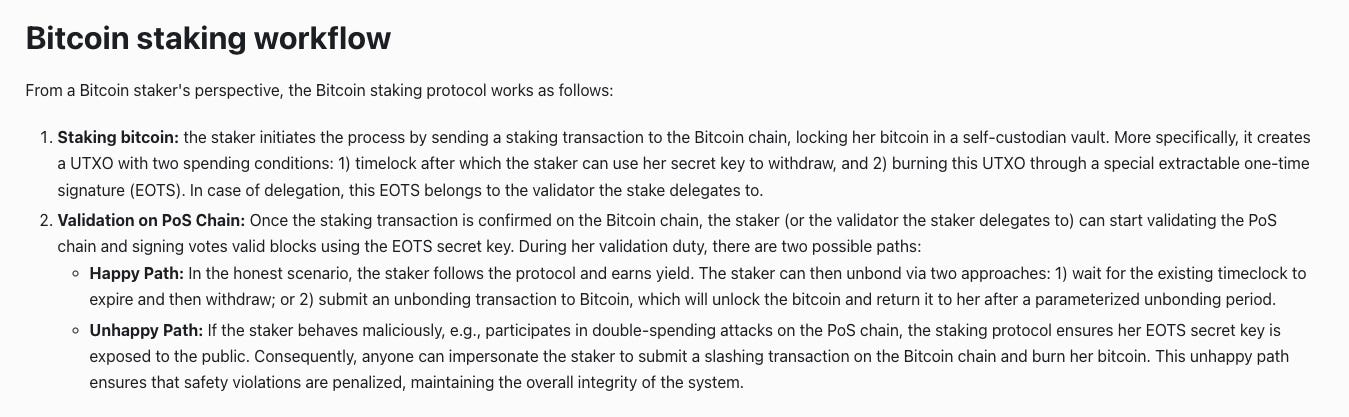

BTC Staking: A Modular and Scalable Two-Sided Market

Babylon's BTC staking protocol establishes a two-sided market, serving as its control plane.

BTC holders can remotely stake their BTC without leaving the network

PoS chains can opt-in for BTC-backed security (think of them as paying customers)

Chains benefit from enhanced security, better economics, and broader adoption

By keeping BTC on its origin chain, Babylon reduces unnecessary risks related to interoperability. To add on, Babylon’s modular approach enables any PoS chain to tap on this massive pool of capital in a “plug and play” model.

But.. how is this possible without smart contracts?

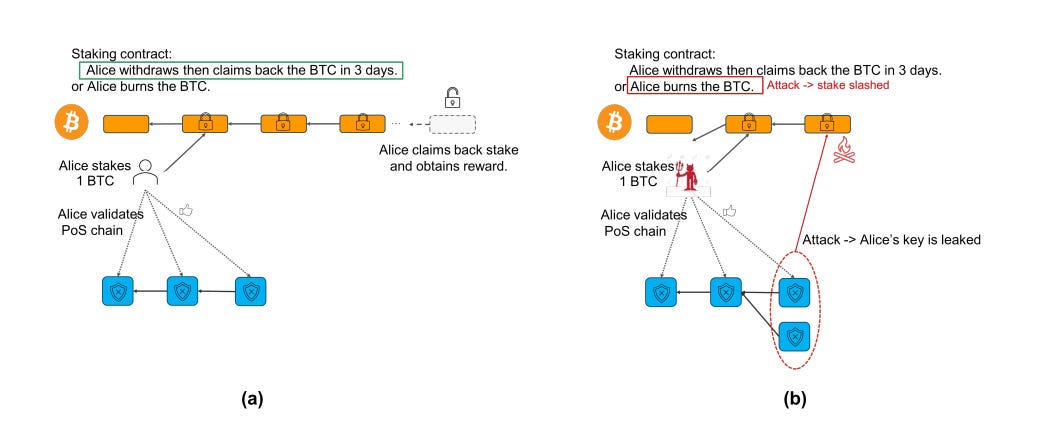

In the staking system, a user’s BTC is locked in specialized vaults on the Bitcoin network, designed with conditions that allow for the slashing of staked BTC if the validator misbehaves on the PoS chain.

Cryptographic methods, such as Extractable One-Time Signatures (EOTS), ensure that any malicious activity exposes the validator's private keys on the Bitcoin network, resulting in their BTC being burned / “slashed”.

Security Guarantees:

Fully Slashable PoS Security: In the event of a safety violation on the PoS chain, at least 1/3 of staked BTC is guaranteed to be slashed.

Staker Security: Honest stakers are guaranteed that their staked BTC is safe and withdrawable (self-custodial vaults), eliminating the need to rely on third parties.

Staker Liquidity: Unbonding (withdrawing) staked BTC is secure and fast, without the need for social consensus or prolonged unbonding periods.

There are way more technical implementations and considerations to be discussed, but we’ll keep it as simple as possible in this piece for digestability’s sake.

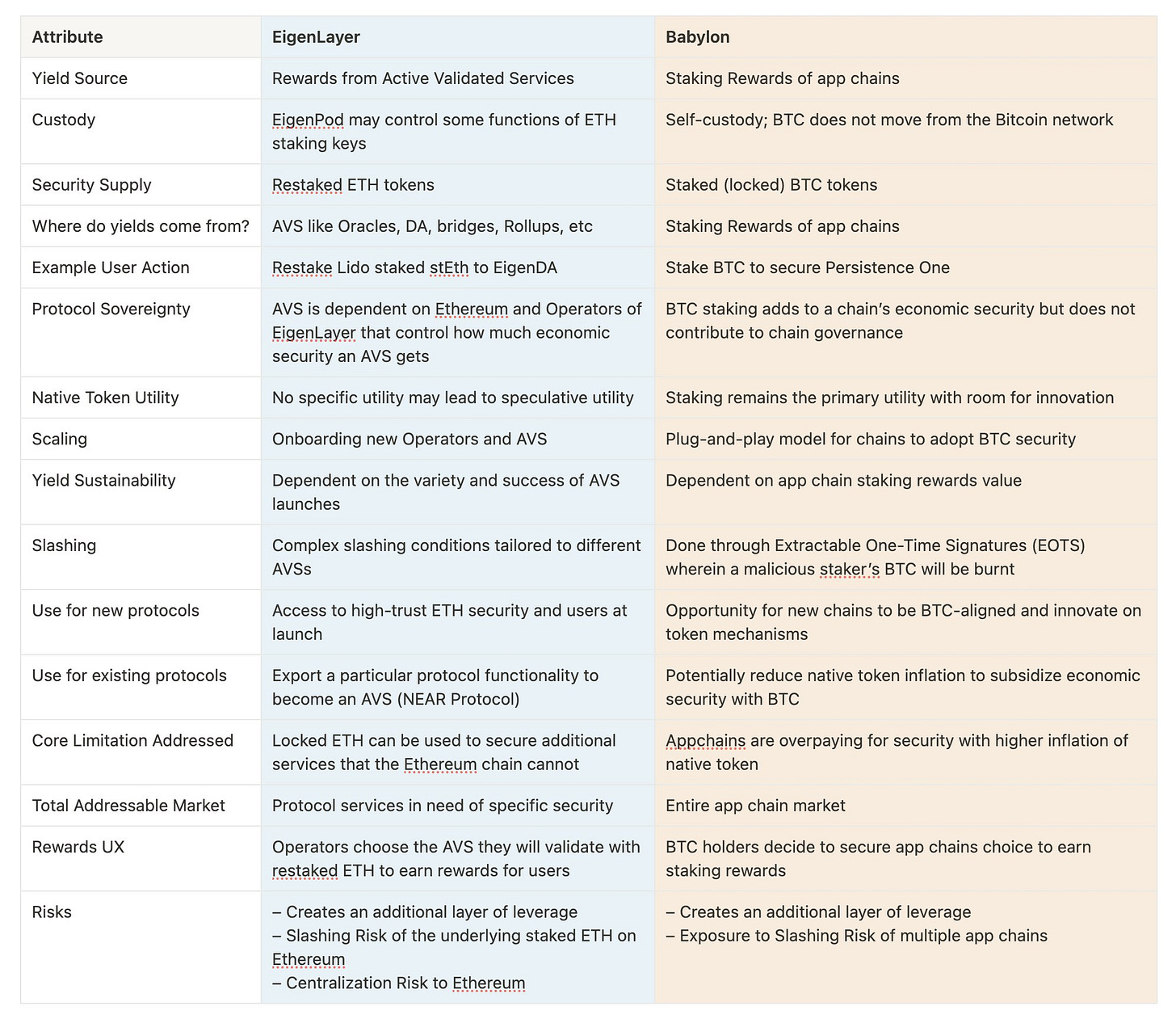

Babylon vs Eigenlayer: A Side-by-Side Comparison

As we discuss the topic of shared security, Eigenlayer naturally enters the conversation.

Shared security offers an economically viable way for new protocols to secure themselves, while aiming to reduce economic expenditures (token emissions) while maintaining robust security measures

Eigenlayer introduced the concept of restaking on Ethereum: where staked assets are rehypothecated to secure a network of Actively Validated Services (AVS).

AVS include new modules and services (eg. data availability layers, oracles, rollup infrastructure providers) that require validation and security.

This enables already-staked ETH to yield even more rewards by extending cryptoeconomic security to protocols in need. On the supply side, Eigenlayer has successfully managed to attract over US$20 billion onto their protocol under their points campaign. Yet, there is a massive supply-demand imbalance with <20 AVS live — effectively providing a near-zero yield for restakers over a year’s time span. The only reward that users were banking on was a thick airdrop - which ended up being a huge letdown.

Core Differences

1. Environment

To start, both protocols operate in completely different environments. Bitcoin is a non-Turing complete blockchain with limited programmability, while Ethereum’s Turing-complete system enables the execution of stored programs on the EVM.

Consequently, Babylon's BTC timestamping and staking protocols rely on complex scripts, EOTS managers, and finality providers, whereas EigenLayer leverages a network of validators, operators, and smart contracts enabling direct integration with Ethereum's validator set.

2. Slashing

Babylon uses Extractable One-Time Signatures (EOTS) to burn staked BTC upon validator misbehavior, while EigenLayer provides customizable, complex slashing conditions tailored to each AVS via smart contracts.

3. Custody

Babylon enables staking without users relinquishing custody of their assets, not overburdening validators; in contrast, EigenLayer's EigenPod may control some functions of ETH staking keys.

4. Go-To-Market

One of Eigenlayer’s biggest challenges is having the need to incentivize both restakers and AVS to onboard their protocol. A weakness in either end leads to a lopsided economy, which we currently observe (Eigenlayer is still a relatively early-stage project with much room to grow). By allowing ETH validators to restake their assets to secure additional services, Eigenlayer also introduces complexities and risks associated with validator overextension and presents clear slashing risks (and depegging risks for LRTs) for negligible rewards.

Babylon, on the other hand, launches with a modular approach (in a plug-and-play model) allowing existing PoS chains to tap on BTC for security. They do not have to bootstrap their own network of paying customers, unlike Eigenlayer. The main concern with Babylon lies in the complexity in executing such intricate mechanisms on the Bitcoin architecture.

Table Comparison

The Only Logical BTC Staking Protocol

It’s pretty clear that Babylon has established a strong moat and clear business model in the BTC space. Personally, I think that their value proposition is strongly differentiated and highly underestimated vs. other related projects.

The transaction of idle assets from surplus to deficit units in a customer-centric model establishes clear efficiency of native BTC being utilized. Though it requires high technical complexity to enforce remote BTC staking with slashability without smart contracts, the Babylon team has set out to conquer a difficult feat.

As their mainnet launch approaches, Babylon will definitely be a project to look out for. I am confident that they are en-route to unlock a massive BTC economy - as we can already observe BTC LSTs being built atop their product (eg. Lorenzo, pSTAKE Finance, Lombard, Bedrock, PumpBTC), approaching US$1 billion in TVL combined.

Since their testnet launch in May 2023, Babylon has integrated with numerous projects beginning with the Cosmos Network, including Injective, Juno, Akash, Nibiru, Persistence, Particle, and many more.

Babylon’s mainnet launched in August 2024, in a phased rollout with caps on staked BTC to be lifted over time.

1.1 Phase-1: Bitcoin Locking

1.2 Phase-2: Bitcoin Staking Activation

1.3 Phase-3: Bitcoin Multi-Staking Activation

If you’ve made it this far, thanks for reading and see you in the next article.

Follow me on X at @ricewinekenny for more insights!

References

https://docs.babylonchain.io/papers/btc_staking_litepaper.pdf

https://docs.babylonchain.io/docs/introduction/overview

https://x.com/PandeyMikhil/status/1793611115600998747

https://www.odaily.news/en/post/5194999

https://blog.pstake.finance/2024/05/25/the-shared-security-war-babylon-vs-eigenlayer/

https://m.odaily.news/en/post/5194999